It is neither from King County nor any other government agency and should not be taken seriously, reported to the Washington State Office of the Attorney General and discarded. From analyzing the letter, we can see that this is fraudulent because:

If you have received a letter such as this, we urge you to help raise awareness of this scam by alerting the government officials and fellow residents.

Let your neighbors and fellow King County residents know that this scam exists. There are those out there that do not have the experience, ability or resources to identity a scam and may fall into their trap.

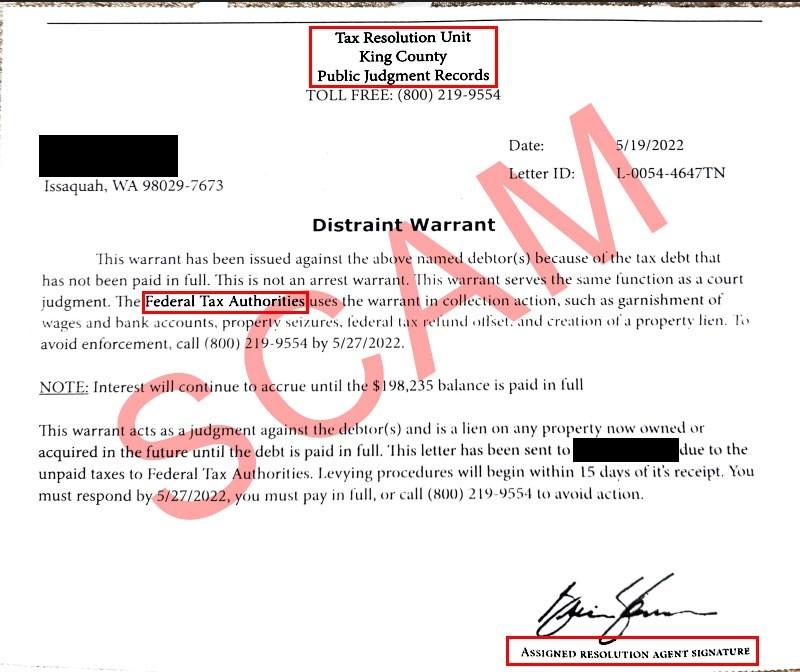

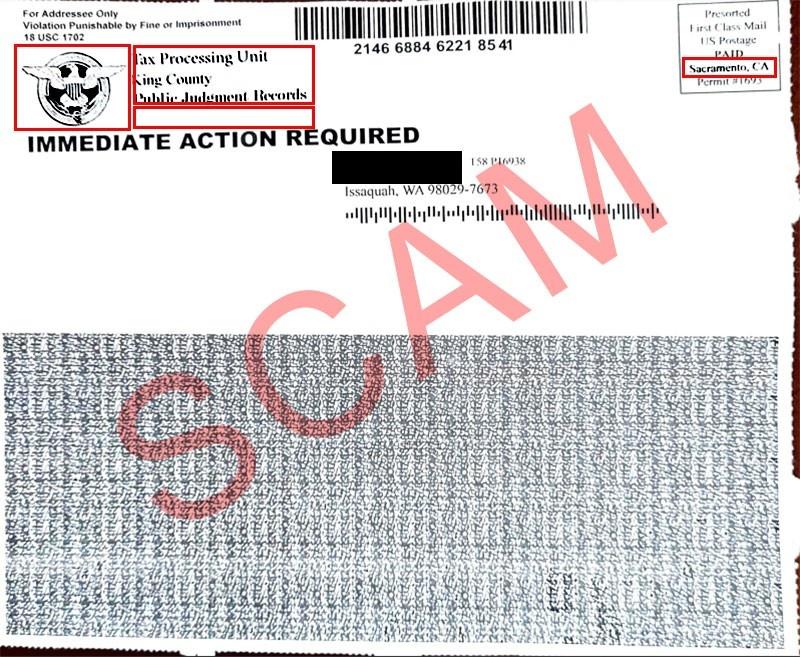

Tax Resolution Unit

King County

Public Judgement Records(800) 219-9554

This warrant has been issued against the above named debtor(s) because of the tax debt that has not been paid in full. This is not an arrest warrant. This warrant serves the same function as a court judgement. The Federal Tax Authorities uses the warrant in collection action, such as garnishment of wages and bank accounts, property seizures, federal tax refund offset, and creation of a property lien. To avoid enforcement, call (800) 219-9554 by 5/27/2022.

NOTE: Interest will continue to accrue until the $198,235 balance is paid in full

This warrant acts as a judgement against the debtor(s) and is a lien on any property now owned or acquired in the future until the debt is paid in full. This letter has been sent to [name] due to the unpaid taxes to Federal Tax Authorities. Levying procedures will begin within 15 days of it's receipt. You must respond by 5/27/2022, you must paid in full, or call (800) 219-9554 to avoid action.

The content on this website is provided for general informational purposes only and is not intended to be legal advice. The information presented on this site should not be construed as legal advice or a substitute for legal counsel. Viewing this information does not create an attorney-client relationship. We do not guarantee the accuracy, completeness, or usefulness of any information on this website and will not be liable for any errors or omissions in the information provided. You should not act or rely on any information on this website without seeking the advice of a qualified attorney.

Comments